Credit card losses fell sharply at Bank of America Corp. in June, to the lowest level in more than a year, fresh data showed Thursday. The rate of delinquent loans also declined.

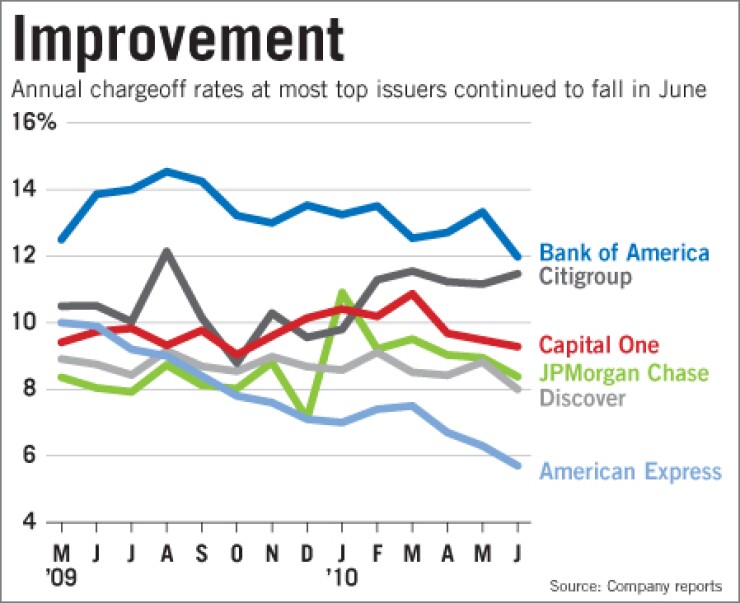

The significant improvement in B of A's chargeoff rate, which has been the highest in the industry, was reflected at nearly all of the six major issuers, according to the companies' monthly filings Thursday with the Securities and Exchange Commission. But B of A's 135 basis-point-drop was the largest among its peers. Bucking the trend, Citigroup Inc. reported a slight increase.

After jumping at the beginning of the year, chargeoffs have generally been on the decline in recent months as consumers continue to pay down debt and banks tighten their underwriting standards.

"Part of the reason we're seeing improving chargeoffs is, the quality of the portfolios [is] stronger than … a year, a year and a half ago," said Sanjay Sakhrani, an equity analyst at KBW Inc.'s Keefe, Bruyette & Woods Inc. in New York. However, he said he is concerned that balance sheet growth remains anemic.

At B of A, for instance, the total of principal receivables in its credit card trust fell 1.4% during June, to $77.3 billion.

Still, credit trends this spring were better than some analysts had expected.

The annual net chargeoff rate at B of A tumbled in June to 11.98%, its lowest level since April 2009. Chargeoffs at B of A had been trending lower since peaking at 14.54% last August but increased during the previous two months.

The rate of total delinquencies on loans in its credit card portfolio fell 23 basis points, to 6.16%. However, the rate of early-stage delinquencies, or loans 30 to 59 days past due, inched up 2 basis points, to 1.46% of total loans.

The annual chargeoff rate at JPMorgan Chase & Co., meanwhile, fell 57 basis points, to 8.38% in June. The rate of loans 30 days or more past due slipped 9 basis points, to 4.13%. (Separately, the New York banking company said Thursday that it had earned $4.8 billion in the second quarter, due in part to fewer loan losses companywide.)

American Express Co., which has shown the most consistent improvement among its peers, said its annual net chargeoff rate fell 60 basis points, to 5.7%, the lowest since the third quarter of 2008. Its chargeoff rate has fallen in 12 of the past 14 months.

American Express is known for catering to a wealthier clientele and has said that its customer base has been able to bounce back from the recession more quickly than others. Its delinquency rate dipped 20 basis points, to 2.7%.

The rate of credit card losses at Discover Financial Services fell 82 basis points, to 8%, and the delinquency rate fell to 4.81%, its lowest since November 2008. At Capital One Financial Corp., the chargeoff rate dipped 20 basis points, to 9.28%. The loss rate in Citigroup's card portfolio rose 30 basis points, to 11.46%.