Regulators in New York recently released guidance for the state’s electric utilities’ distributed system implementation plans, which are due next June.

One of the items that utilities will have to address is the need for advanced metering infrastructure to meet the goals of New York’s Reforming the Energy Vision. REV calls for the elimination of electric peaks, greater distributed generation, and more consumer participation in energy markets, and requires utilities to enable those transactions.

“There’s a very lively debate about what kind of metering is absolutely necessary,” said Audrey Zibelman, chair of New York’s Public Service Commission.

The debate revolves around whether all customers even need a two-way digital smart meter. There are also questions about baseline communications capabilities, and whether there are other technologies that could provide the same granular data to utilities and third parties at a lower cost. But for some of the largest utilities in the state, the plan for a full rollout of meters is already underway.

At the beginning of 2015, Consolidated Edison filed a rate case that included a six-year smart meter implementation schedule. Con Edison was handed a one-year rate freeze, but the smart meter plan has continued to move forward.

Earlier this month, Con Edison filed an updated business plan for advanced metering infrastructure. It will involve 4.7 million meters to its gas and electric customers at a cost of about $1.3 billion. It will come with near-real-time data available to customers and a network that will support far more than meters.

“It’s the biggest project in Con Edison’s 190-year history,” said Tom Magee, general manager of Con Edison’s automated meter initiative. Con Edison has a conditional approval to move forward with back-end IT work at a cost of nearly $70 million while the utility awaits a full ruling early in 2016.

The timing for a smart meter push

Con Edison is not alone. Its subsidiary, Orange and Rockland Utilities, has filed for AMI in its most recent rate case and will file an AMI business plan at the same time as the distributed system implementation plan (DSIP) filing. Iberdrola has also included AMI in its most recent rate case and will include more details in its DSIP filing next year.

Zibelman said that the DSIPs will have to detail how smart meters will allow for advanced distribution system management, while also showing how the meters would provide customers more information. Utilities will have to define which parts of an AMI system should be owned by the utility versus which could be owned or maintained by a third party.

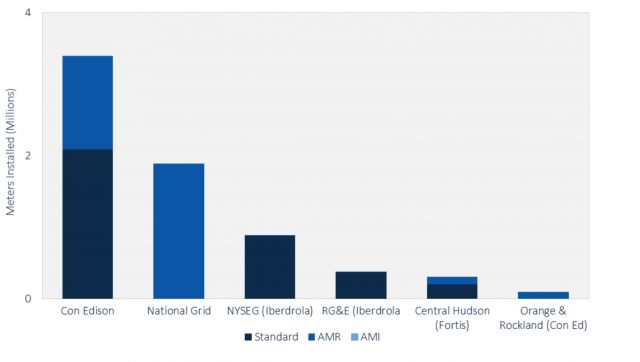

There are nearly 60 million smart meters in the U.S., but the bulk of the meters in New York have not yet been upgraded.

Source: EIA, GTM Research

The $1.3 billion cost is in line with other large AMI rollouts, including those of CenterPoint Energy and Commonwealth Edison.

Operations and maintenance costs are higher in Con Edison’s filing compared to some other utilities, according to Andrew Mulherkar, grid edge analyst with GTM Research. That will likely have to be justified to regulators. The system is still projected to save $1 billion over 20 years after all costs are considered.

Real-time data, advanced analytics

One reason for the higher-than-average operations costs could be that Con Edison is preparing for vastly improved IT capability to make the most of the system. Con Edison plans to have the most advanced analytics and near-real-time data of any meter deployment on the planet. “We’re designing the system with advanced analytics in mind,” said James Prettitore, director of technology services at Con Edison.

The system would pull in more than 1.5 billion data points daily. That could signal a change from some earlier smart meter deployments, in which large amounts of data was collected, but utilities were not making use of it across utility operations.

As with other New York utilities, Con Edison will also have to find ways to monetize some of that data under REV by providing services to third parties and customers -- all while ensuring customer privacy. Con Edison is confident that offering near-real-time data in 15-minute intervals (5-minute intervals for large C&I customers) will provide the sort of granular information that can create new earning mechanisms for utilities and third parties.

Third parties are already arguing that some of the benefits from a utility AMI deployment could be provided at a lower cost through other means, such as deploying smart inverters or by leveraging home Wi-Fi connections. For instance, the Retail Energy Supply Association argued that an expanded time-of-use or smart home rate should be the “province of competitive ESCOs and DER providers” rather than being set by the utility.

Utilities that do not choose large AMI deployments will likely still have to agree on some sort of baseline communications so that third parties can deploy smart meters to customers who want more advanced energy service offerings. “What kind of metering do you need in what circumstances?” asked Zibelman.

The answer to that question could influence how much of the $1.3 billion can be rate-based and what portion might be recouped through market-based earnings, especially if additional costs for granular analytics mean that some customers will benefit more than others. That issue will be sorted out during Track 2 of the REV proceeding.

“There’s certainly an opportunity to reallocate some of the cost of the system,” said Zibelman.

Con Edison maintains that the full benefits of the network can only be realized if there’s a full deployment, particularly for ramping up demand response opportunities, upgrading outage management systems and doing voltage management. “You just can’t do it without wide-scale meters,” said Prettitore.

The business plan points to the success of residential demand response programs at SMUD and OG&E as well as more than $40 million per year in fuel savings costs from voltage optimization that can be done with the smart meter network.

More than just meters

As with many other AMI deployments, Con Edison and other New York utilities are looking at the full potential of the meters.

Con Edison is already meeting with stakeholders such as the municipal government of New York City and the Metropolitan Transit Authority to evaluate additional opportunities, such as smart streetlights that could be networked on the smart meter communications infrastructure, as Florida Power & Light is doing in Miami-Dade County.

The business plan Con Edison put together also identifies additional value in sensors that could leverage the AMI network for applications such as methane detection and arc fault detection on the underground system.

The utility is currently evaluating meter vendors for the contract, and expects each one to bring an AMI system with open-source architecture that will allow for layered applications.

“We don’t think REV can happen without this project,” said Magee. “These are the technology and tools to enable REV.”