Survey: We're stressed by retirement preparations – but doing little to prepare

We're stressed out about our retirement prospects — but doing little to get ready, a new report says.

Three in 10 U.S. workers say they feel mentally or emotionally stressed about preparing for what are supposed to be the golden years, according to the Employee Benefit Research Institute's 2017 Retirement Confidence Survey, the nation's longest-running examination of its kind.

But just six in 10 Americans said they have saved for retirement. Only four in 10 have tried to calculate how much income they'd need each month after leaving the work world behind. And little more than one in 10 have prepared a written financial plan for retirement, the survey found.

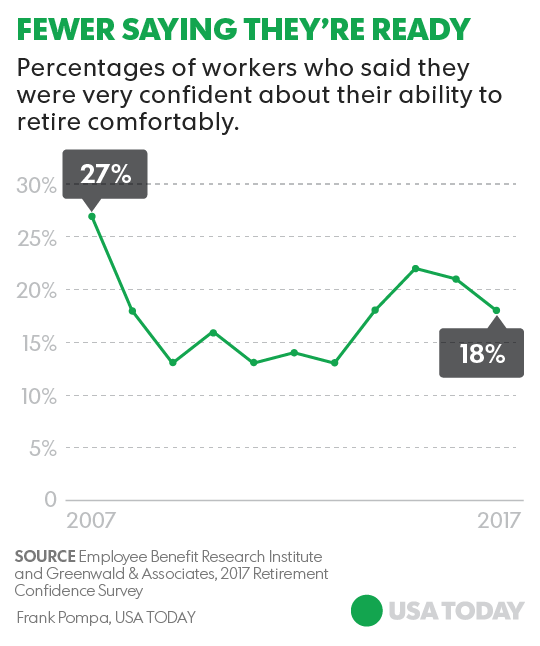

The stress and relative shortage of planning also may be taking a broader toll on worker attitudes. Just 18% of the survey respondents reported they felt "very confident" about being able to afford a comfortable retirement. The result is down from 21% of those who professed similarly strong confidence in last year's survey.

"I continue to be struck by the relatively small share of workers who do formal retirement planning," said Lisa Greenwald, the report's co-author and assistant vice president of public opinion survey company Greenwald & Associates. "Some of these critical retirement planning steps don't cost workers anything, like estimating Social Security or thinking through what your expenses may be in retirement."

Other major findings from the report include:

- American workers who have retirement plans have saved more that those who have not, have taken more steps to prepare for retirement and feel less anxious about their preparations.

- Nearly three in four workers not currently saving for retirement say they would be at least somewhat more likely to start if employers matched their contributions.

- Roughly half of all workers say they're very or somewhat confident about being able to afford medical expenses in retirement.

- Workers aged 25 to 34 report were slightly less likely to prepare than their older colleagues. In all, 52% of the younger workers said they or their spouses have saved for retirement, compared with 63% for those aged 45-54 and 70% for those aged 55 or over.

The findings are based on the results of online interviews with 1,082 workers and 589 retirees. The results have a margin of error of plus or minus 3 percentage points for workers and 4.1 percentage points for retirees. The survey was conducted from Jan. 6-13, shortly before this year's change in White House administrations.

Although the percentage of Americans who said they felt most confident about a comfortable retirement fell in the 2017 report, the findings were generally in line with the results of past surveys, said Craig Copeland, EBRI's senior research associate and the report's co-author.

Whether that changes likely "will depend on how the economy does going forward," said Copeland.

Worried about financing your retirement?

Here are planning tips from Robert Powell, a regular USA TODAY contributor and editor of Retirement Weekly:

- Determine what your essential expenses will be, and try to make sure you have enough sources of guaranteed income — such as Social Security, a pension, and/or an income annuity — to cover those costs. Use stocks and bonds to fund discretionary expenses and any bequests.

- Make sure you have a traditional IRA and/or 401(k), a Roth IRA and/or Roth 401(k), and taxable accounts. Fund those accounts with the right sort of investments. This offers the best chance of creating tax-efficient income in retirement.

- Identify the risks you could face during retirement — including long-term care costs, inflation, and longevity — and try to manage and mitigate them. Long-term care insurance could help pay for long-term care expenses. A deferred income annuity addresses longevity, the risk of outliving your money.

Follow USA TODAY reporter Kevin McCoy on Twitter: @kmccoynyc